By Howard Schneider

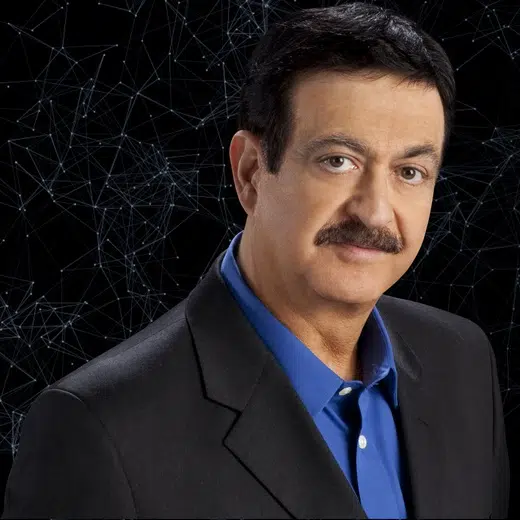

COLUMBIA, South Carolina (Reuters) – The current level for the Federal Reserve’s benchmark interest rate should cool the economy enough to return inflation to the central bank’s 2% target, with the strength of the job market giving officials time to wait, Richmond Fed President Thomas Barkin said on Monday.

“I am optimistic that today’s restrictive level of rates can take the edge off demand in order to bring inflation back to our target,” Barkin said in remarks prepared for delivery to the Columbia, South Carolina Rotary Club.

Barkin said that while inflation data so far this year has been “disappointing,” he doesn’t see the economy overheating.

After falling steadily last year recent inflation data has ticked higher; though first-quarter growth in gross domestic product was a tepid 1.6%, Barkin said measures of underlying demand grew a “strong” 3.1%.

The unemployment rate, meanwhile, remains at 3.9%, though job creation slowed in April to 175,000, more in line with pre-pandemic norms.

For recent inflation data in particular, Barkin said, the challenge is whether policymakers should “take more signal from the past three months, or the prior seven,” when the economy seemed to be making steady progress back to the Fed’s inflation target.

The “data whiplash,” he said, argues for waiting to be sure inflation will resume a steady decline.

The Fed last week held its benchmark rate steady in the 5.25% to 5.5% range, with Fed Chair Jerome Powell saying further hikes were unlikely – but also giving little sense of when expected rate cuts might begin.

The start of the year “has only confirmed the value of the Fed being deliberate,” said Barkin, a voter this year on interest rate policy. “The economy is moving toward better balance, but no one wants inflation to reemerge. We have said we want to gain greater confidence that inflation is moving sustainably toward our 2% target. And given a strong labor market, we have time to gain that confidence.”

(Reporting by Howard Schneider; Editing by Andrea Ricci)

Comments