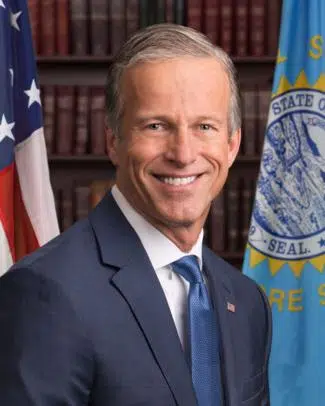

WASHINGTON, D.C. (KELO.com) — John Thune is going to bat for the nation’s families.

Thune held a hearing assessing the effect of the Child Tax Credit over the course of its 25-year history.

As a result of the Tax Cuts and Jobs Act of 2017, Congress doubled the maximum CTC amount, providing qualifying families with a maximum $2,000 credit per dependent child, up to the age of 16.

The expanded CTC is set to expire in 2026, and families across the nation would see their benefits revert back to 2017 levels if Congress does not act.